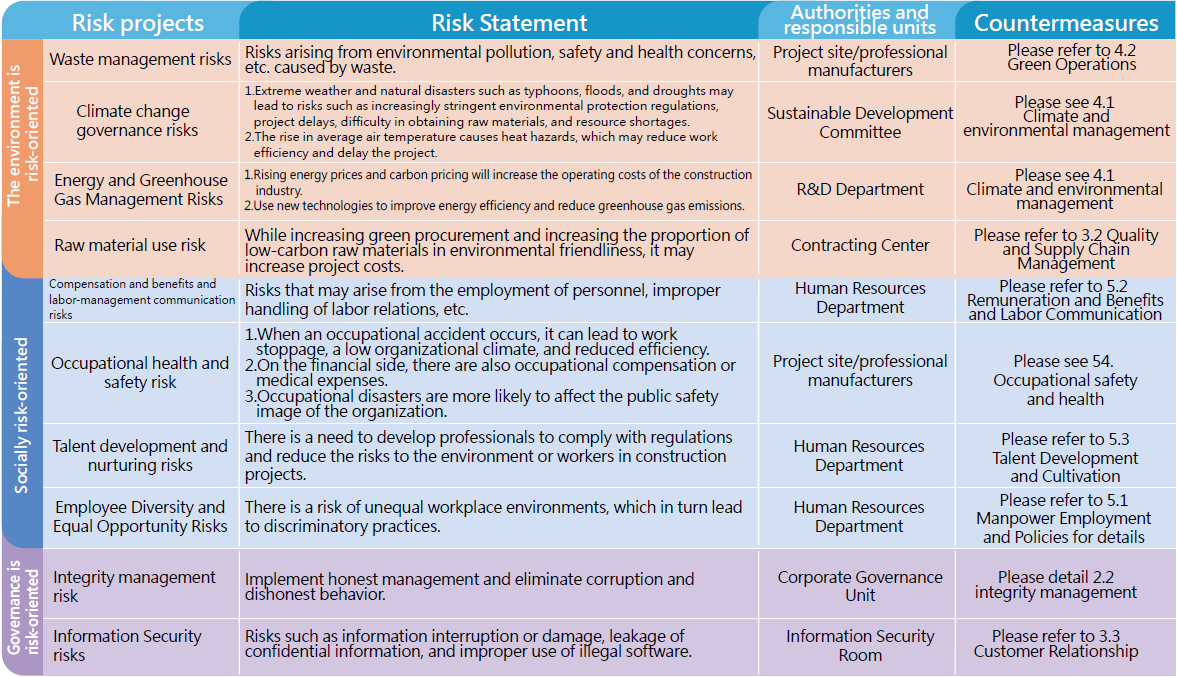

In recent years, due to the rapid changes in climate and the environment, businesses have faced numerous potential and emerging risks and challenges in their daily operations. Operating within the construction industry, Ruentex is particularly impacted by government-driven net-zero transition policies, which have increased the proportion of green procurement and, consequently, raised raw material costs. In addition, the declining birth rate trend poses a risk of talent shortages.

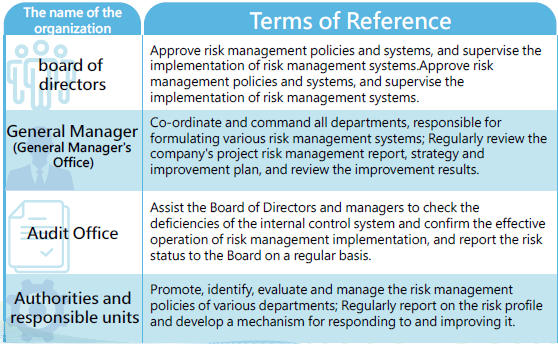

To enhance operational resilience and enable timely identification and response to various risks, each type of risk is managed by the responsible departments through dedicated operational reports, serving as the first line of risk prevention and control. Moreover, Ruentex has established a stringent internal control system, with the internal audit department conducting regular or ad hoc audits and producing corresponding reports.

For significant operational risks that are identified, the General Manager’s Office assumes overall responsibility for risk management, reporting the status and improvement measures to the Board of Directors for tracking and oversight.